An IMG Guide to Credit Scores

04 Sept, 202314 Minutes

When you arrive in the UK to work in the NHS, you can rest assured you’ll be on a competitive doctor’s salary. However, that doesn’t mean you don’t have things to organise when it comes to your finances. As soon as you become a UK visa holder, you will gain a UK credit score that will determine your ability to borrow money, and it’s your job to ensure you build and maintain a healthy rating.

Even if you had a good credit rating in your home country, that will unfortunately not translate to the UK. Due to this, you will need to build a credit score from scratch. Don’t worry - with a little bit of guidance, this can easily be done.

What is a Credit Score?

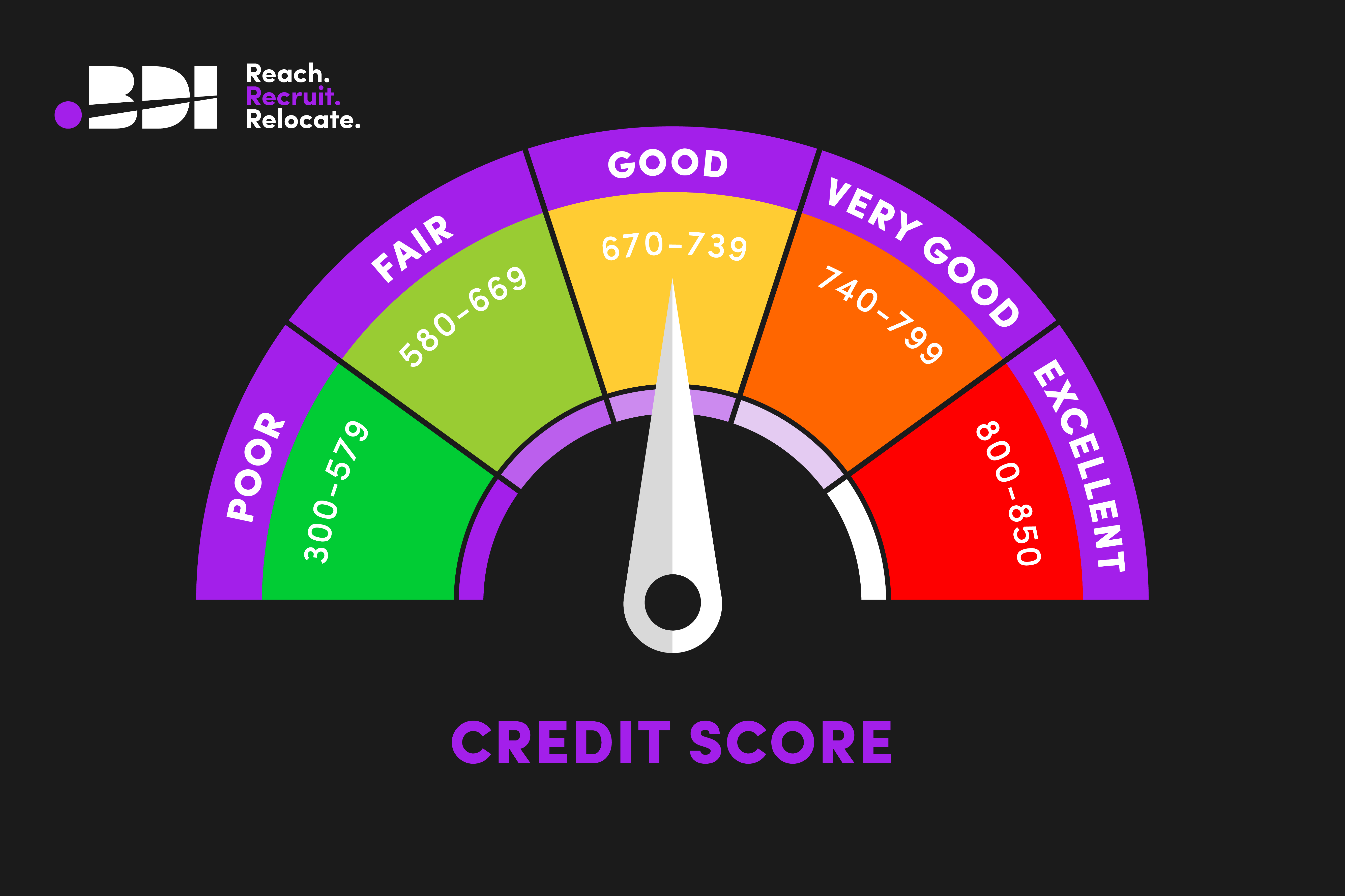

A credit score is a three-digit number that rates your financial reliability when it comes to borrowing money. Every adult in the UK – including international doctors – has a credit rating, even if they have not borrowed money. If you’re brand-new to the country, your credit score will be pretty low, and you’ll need to build it to be seen as a desirable candidate to lenders.

Your credit score number will increase or decrease over time depending on several factors, but primarily your borrowing habits. For example, a person who has a credit card and frequently pays money back into it, never maxing it out, will likely increase their score over time. However, those with bankruptcies or unpaid credit commitments will notice a significant hit to their credit rating.

You won’t be provided with your credit rating number as a new NHS doctor. Instead, you’ll need to seek it out. Luckily, this is easily done, and three reliable credit rating agencies allow you to check your score: TransUnion, Equifax, and Experian. By signing up for one of these agencies, you can check and re-check your score whenever you want to. Each also provides access to a credit report, although this is not always free.

Building a credit rating from scratch isn’t the fastest process, but it doesn’t have to take years. If you are committed to building a good score, you can see an improvement in as little as three months.

Will You Have a Credit Score Upon Arriving in the UK?

Yes – as soon as you enter the UK as an NHS doctor, you will automatically have a credit rating, even if you haven’t made any payments yet! However, it will be a beginner’s credit score, so it won’t be very good. The good news is that a beginner’s score is like a blank slate, and you can build on it over time. Your goal is for your credit score to increase as much as possible. Generally, any score above 670 is considered good, with scores above 740 considered very good.

Why Are Credit Scores Important?

As a medical doctor living in the UK, you will find it beneficial to have a good credit score because lenders use credit ratings as indicators of who is a good candidate for loans.

If you’re a new NHS doctor who has not received a relocation package, a good credit score will be even more handy, as you might need to borrow money or purchase items on finance to get on your feet. Below are the key areas where a good credit score helps.

- Credit Cards

While certain credit cards are specifically for building a good credit rating (and thus won’t require the best credit score), most credit cards with high limits will require you to have a good credit rating.

- Loans/Finance

If you need a loan, you won’t get a good deal with a poor credit rating. On the other hand, a high credit rating will grant you access to some of the better financial options out there.

Also, if you’re a new NHS doctor looking to purchase things on finance, such as home goods, a good credit rating will be essential as the lender wants to know you are sensible with money borrowing.

- Mortgages

While you may not plan on purchasing a home as soon as you enter the UK, there’s a chance you’d like to own property once you have settled into your new role. To buy property in the Uk, you will almost certainly need a mortgage, and mortgage lenders always take credit rating into account, so it’s crucial that you have built a good credit score over time.

- Renting

Credit rating can even determine whether or not you’ll be chosen as a tenant. While you don’t need a good credit score to rent in the UK, some landlords may use the score to determine whether they choose you as a tenant – especially if the property has multiple applications. If you’ve proven that you are good at borrowing money, the landlord will be more likely to choose you as a tenant, as they’ll feel they can trust you to pay rent on time.

- Phone Contracts

When you arrive to work for the NHS, one of the first things you’ll need to consider is getting a UK phone number. You can purchase a SIM card for this, automatically giving you a UK number. However, many international doctors prefer to get a phone contract, which often ends up cheaper in the long run, with many phone contracts also supplying a phone. The UK phone networks will take your credit rating into consideration, so to get a good option, you need to have a good score.

As you can see, getting a good credit score should be on your list of things to do upon arriving in the UK. While it will take a few months to build a decent one, it’s a worthy investment of your time.

Building Your Credit Score

First, you should understand what impacts your credit score. Your payments, the type of credit you’ve had, the amount of debt you have, and the amount of time you’ve had a credit rating all play a role in the score, which means changing any of them will have an impact.

You may be wondering how exactly do you build a credit score as an international doctor? Doing so doesn’t require too much effort, which is good news for any busy medical professional working for the NHS! Doing the following things will help you build a good credit score.

1: Open a UK Bank Account

The first step to building a credit score as a new UK doctor is opening a bank account. Obviously, as an NHS doctor, you will need a UK bank account for your salary and not just to build your credit rating. With this, you’ll be able to receive your salary and pay your bills. You’ll also receive a debit card for shopping.

Of course, opening a UK bank account means choosing one of the UK banks. Here are some of your options:

- Natwest

- Santander

- Monzo

- HSBC

- Barclays

- Nationwide

- Lloyds Banking

Each bank has its own benefits. A good way to choose the right bank is to compare the advantages and see which appeals to you most. Some banks offer extras, such as insurance or special offers, which might appeal to you. Other banks – like HSBC – have a wide range of bank locations around the UK, which can be useful.

2: Pay All Bills on Time

When you arrive in the UK and settle into a home, you will have several bills to pay. That will include council tax, phone contract, energy bill, and water bill. Some bills – like council tax – will have zero influence on your credit rating. On the other hand, other bills, including utility bills and mobile phone bills, will affect your score. Therefore, to ensure your score builds over time, be sure to pay all your bills on time, every time.

3: Pay Bills by Direct Debit

Speaking of paying bills, it’s a good idea to pay all of your household bills by direct debit. If you are responsible for sending the money manually, you may forget to do so for one month, and that can damage your credit rating. That’s why paying by direct debit makes sense – it ensures the bills get paid automatically, so you don’t even need to think about it.

4: Get a Credit Card

With a fresh credit rating, the chances are you won’t be able to get a credit card with a high limit. However, you will likely be able to get a credit builder credit card – a credit card that will help you build your credit over time. Once you have one of these, the best way to build your credit rating is to make frequent, small payments – always on time. Setting up a direct debit will help you never miss a payment.

5: Avoid Over-applying for Credit

If you apply for credit and get rejected, don’t keep applying. Multiple applications to lenders will negatively affect your credit score. If you want to apply again, wait a little while before doing so – at least three months.

6: Keep Track of Your Credit Rating

Check your credit rating routinely, ensuring you understand the number and what it presents. If you have good lending habits, you should see the number increase over time, making you a more desirable candidate for lending. If you have any credit score issues or don’t understand the rating, you can also check your credit report. This will give you a breakdown of everything on your report, and you’ll be able to see what has impacted your score over time. You should correct any factual errors as soon as they come up; these can negatively impact your score through no fault of your own.

7: Get on the Electoral Register

Being on the UK electoral register is crucial, as it shows lenders that you are who you say you are. It can also improve your credit rating slightly. Doing so is easy – you can register online on the UK Government website. Once you have done so, you can also vote in UK elections however your immigration status might determine whether or not you are eligible for this.

Keeping Track of Your Credit Score

So, you’ve worked hard to build your credit score and want to know exactly where you stand. Or, maybe you’ve just landed in the UK as an NHS doctor and want to know your starting score. In either case, you’ll want to be able to check and keep track of your score, and you can do just that with one of the three authorised UK credit rating agencies: Experian, TransUnion, and Equifax.

As mentioned above, you’ll need to sign up for one of these agencies, which will require giving details like your name, email address, home address, and phone number. However, it shouldn’t cost you anything. Once you’ve signed up, you can access your account and view your credit score. Your score updates regularly, so it’s worth checking each month. With Experian, you can even boost your credit rating by linking your Experian account to your bank account. Doing so will consider additional information, such as your monthly subscriptions, when determining your credit rating.

Building Your Credit Score: Key Points to Remember

Building your credit score won’t be something you can do overnight. However, over several months, you can see significant improvement in your score, which will help you get accepted for finance, loans, mortgages, and rental agreements. Here are the key points to keep in mind:

- Every Person in the UK has a credit rating

Even if you are brand-new to the country as an NHS doctor, you will still have a credit rating! It will be low, so increasing it as soon as possible is worthwhile.

- Setting up direct debits is a good idea

Missing payments will negatively impact your credit rating. To avoid this, try to set up direct debit payments for all your bills. That way, you won’t have to think about it, and your credit rating will slowly improve.

- You can check your credit score at a credit reporting agency

Keeping track of your credit rating – and checking your credit report – is a good way to know where you stand. With either Experian, TransUnion, or Equifax, you can stay up to date with your credit rating.

- A good credit score assures lenders you are a good candidate

Credit ratings exist to reassure lenders that you are a sensible borrower. The sooner you build your credit rating, the sooner you become an appealing candidate to lenders and have more flexibility in your options.

BDI Resourcing – Reach. Recruit. Relocate.

We hope you’ve found this guide to credit scores helpful and encourage you to read more about life in the UK for IMG Doctors using our IMG Media Hub. There you’ll find all the latest news and insights, with featured articles and videos.

If you’re considering a career move then please reach out to our friendly team who will be more than happy to provide advice and guidance on CV and interview preparation as well as sourcing all of the latest NHS jobs for you. We’re proud to have reached, recruited and relocated more than 1500 doctors in to new roles in the NHS with only 5-star feedback.